Podcast Alert - Navigating Annapolis Real Estate with Jen Holden

🎧✨ Podcast Alert! Our very own Jen Holden recently rocked the airwaves on the Maryland Real Estate Influencers podcast with Jennifer Healy! 🌟Dive into this episode 🎤 to hear Jen's insightful journey of 13 years in real estate, balancing family life, and her unique approach to navigating the eve

Read More

National Real Estate Insight Report - October 2023

Monthly median house sales price since 1990: The September 2023 median price declined slightly from August, but was up 2.5% year-over-year. U.S. median house sales price appreciation since 1990. Over the longer term, homeownership has typically been a great builder of household wealth. Med

Read More

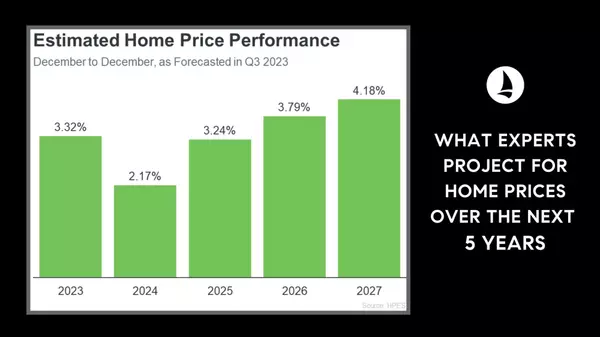

What Experts Project for Home Prices Over the Next 5 Years

What Experts Project for Home Prices Over the Next 5 Years If you're planning to buy a home, one thing to consider is what experts project home prices will do in the future and how that might affect your investment. While you may have seen negative news over the past year about home prices, they’re

Read More

Categories

Recent Posts