5 Best-Kept Secrets for Selling Your Home

View this post on Instagram A post shared by Jen Holden | Annapolis Expert Realtor ⚓️🦀 (@thejenholdengroup) When we are listing a home for sale, we work diligently with our sellers to help them get maximum profit for their homes. We are passionate about making sure o

Read More

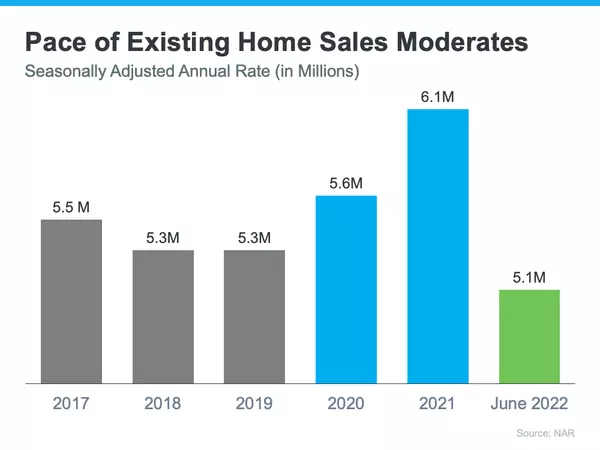

A Window of Opportunity for Homebuyers

A Window of Opportunity for Homebuyers Mortgage rates are much higher today than they were at the beginning of the year, and that’s had a clear impact on the housing market. As a result, the market is seeing a shift back toward the range of pre-pandemic levels for buyer demand and home sales. But th

Read More

Don't Miss Out! Get On Our Mailing List!

Introducing Greater Severna Park Living by the Jen Holden Group! Welcome to our new lifestyle magazine, which provides local flavor on real estate trends, homeownership insights, and local happenings in the greater Severna Park community. Are you on our mailing list? If you aren't receiving th

Read More

Categories

Recent Posts